NetSol Technologies Announces Third Quarter Fiscal Year 2010 Financial Results, Highlighted by a 78% Increase in Sales, Improved

May 12 2010 - 5:55AM

NetSol Technologies, Inc. ("NetSol") (Nasdaq:NTWK) (Nasdaq

Dubai:NTWK), a U.S. corporation providing global business services

and enterprise application solutions to private and public sector

organizations worldwide, today announced its consolidated financial

results for the third quarter ended March 31, 2010 highlighted by

an impressive increase in sales and a return to profitability.

Third Quarter Fiscal Year 2010 Consolidated Financial

Highlights

-

Revenues for the fiscal year 2010 third quarter totaled $8.9

million, up from $5 million for the same period year-over-year,

representing an increase of $3.9 million, or 77.8%.

-

Net income per share totaled $0.02 versus a loss ($0.19) for the

same period a year ago.

-

Net revenues from license fees totaled $3.64 million, an

increase of 1,022% versus the same period a year ago.

-

100% sequential growth in the core NetSol Financial Suite™

license sales.

-

Gross margin increased to 61.3% compared to 10.7% in the same

period a year ago.

-

Operating income increased to $2.58 million as compared to an

operating loss of $4.26 million in the same period a year ago.

-

EBITDA totaled $1.9 million or $0.05 per diluted share, versus

an EBITDA loss of $3.5 million, or a loss of ($0.13) per diluted

share, in the year-ago period.

-

The Company reiterates previous guidance for fiscal year 2010

projecting revenues in the range of $33.0 million and $35.0

million, representing full-year revenue growth of between 25% and

32% over fiscal year 2009. The Company projects a return to GAAP

net income for fiscal year 2010, versus a GAAP net loss of $0.30

per diluted share for fiscal year 2009. License revenues for fiscal

year 2010 are projected to increase more than 100% over fiscal year

2009.

Nine-Months Ended March 31, 2010

-

Revenues for the nine months ended March 31, 2010 totaled $26.1

million up from $19.6 million for the same period year-over-year

representing an increase of $6.5 million or 33%.

-

Net revenues from license fees totaled $9.52 million, up from

$3.50 million for the same period year-over-year, representing an

increase of $6.01 million, or 171.6%.

-

Gross margin increased to 59.3% compared to 34.1% in the same

period a year ago.

-

Operating income increased to $5.42 million as compared to an

operating loss of $5.95 million in the same period a year ago.

-

EBITDA totaled $4.07 million, or $0.12 per diluted share, versus

an EBITDA loss of $3.04 million, or a loss of ($0.11) per diluted

share, in the same period a year-ago.

Najeeb Ghauri, NetSol Technologies chairman and chief executive

officer, commented: "We are very pleased with our performance

in the third fiscal quarter, highlighted by a 78% increase in our

sales versus the same period a year ago and a return to quarterly

profitability for the first time in six quarters. It is our aim to

finish the year completely profitable on the fiscal year analysis.

Our financial results continue to deliver material improvements in

every major metric of financial health, and we are optimistic about

future outlook. Our efforts to invest in our core NetSol Financial

Suite (NFS)™ throughout the global economic downturn has well

positioned the company to leverage the upturn in customer activity

that we continue to see, particularly in China and APAC region in

general. We enter the end of our fiscal year 2010 with the most

positive momentum in the company's recent history and we see

increased interest among our major customers as well as new

potential partners in the sector. Additionally, we see excellent

opportunities for collaboration and strategic initiatives as we

head to the conclusion of the fiscal year 2010."

BUSINESS HIGHLIGHTS

-

NetSol Technologies North America announced the formal launch of

smartOCI™, a SAP-Compatible Multiple-Catalog Search Engine. The

launch will be on May 17, 2010, at the SAP SAPPHIRE Conference in

Orlando, Florida, targeting approximately 1,000 SAP SRM platform

customers. smartOCI™ will be sold on subscription basis with the

software delivered as a Software as a Service (SaaS) model.

-

NetSol Technologies and Atheeb Group formally launched Atheeb

NetSol Limited, a new entity joint venture in the Kingdom of Saudi

Arabia. The Atheeb NetSol limited joint venture is focused on

market development opportunities around penetrating the software

engineering arena in key business sectors such as

telecommunications, defense, public sectors and finance, among

others.

-

NetSol Technologies signed a new agreement with a Chinese

finance company that has a major European bank and a multi-billion

dollar Chinese financial services group as partners. The client

selected NetSol's NFS BI Module, a unique end-to-end Business

Intelligence offering.

-

A FORTUNE 50 client upgraded the NetSol Technologies LeasePak

License. The highly scalable LeasePak solution offers North

American clients the ability to scale from a core platform via

modular components.

-

NetSol Technologies Thailand won a major contract for the NetSol

Financial Suite™.

-

NetSol Technologies, Ltd. Pakistan has parlayed its reputation

as a quality IT company into participation in three new

pre-qualified bids in the public sector.

-

NetSol Technologies North America downsized its office space

from Emeryville to Alameda in California, saving an estimated $5.0

million over the next five years.

Conference Call and Webcast Information

NetSol will host a conference call today, May 12, 2010, at 11:00

a.m. ET (8:00 a.m. PT) to review the quarterly financial and

operational performance. Najeeb Ghauri, NetSol Technologies

chairman and chief executive officer, will host the call.

To participate in the call please dial (877) 941-1429, or (480)

629-9666 for international calls, approximately 10 minutes prior to

the scheduled start time. Interested parties can also listen via a

live Internet webcast, which can be found at the Company's website

at http://www.netsoltech.com.

A replay of the call will be available for two weeks from 2:00

p.m. May 12, 2010, EDT until 11:59 p.m. EDT on May 26, 2010. The

number for the replay is (800) 406-7325, or (303) 590-3030 for

international calls; the pass code for the replay is 4294953. In

addition, a recording of the call will be available via the

Company's website at http://www.netsoltech.com for one year.

About NetSol Technologies, Inc.

NetSol Technologies, Inc. (Nasdaq:NTWK) (Nasdaq Dubai:NTWK) is a

worldwide provider of global IT and enterprise application

solutions. Since its inception in 1995, NetSol has used its

BestShoring™ practices and highly experienced resources in

analysis, development, quality assurance, and implementation to

deliver high-quality, cost-effective solutions. Specialized by

industry, these product and services offerings include credit and

finance portfolio management systems, SAP consulting and services,

custom development, systems integration, and technical services for

the global Financial, Leasing, Insurance, Energy, and Technology

markets. NetSol's commitment to quality is demonstrated by its

achievement of the ISO 9001, ISO 27001, and SEI (Software

Engineering Institute) CMMI (Capability Maturity Model) Maturity

Level 5 assessments, a distinction shared by fewer than 100

companies worldwide. NetSol Technologies' clients include Fortune

500 manufacturers, global automakers, financial institutions,

utilities, technology providers, and government agencies.

Headquartered in Calabasas, California, NetSol Technologies has

operations and offices in Alameda, Adelaide, Bangkok, Beijing,

Karachi, Lahore, London, and Riyadh.

To learn more about NetSol, visit www.netsoltech.com.

The NetSol Technologies, Inc. logo is available at

http://www.globenewswire.com/newsroom/prs/?pkgid=7396

Use of EBITDA

EBITDA is defined as earnings before interest, taxes,

depreciation and amortization. The Company uses EBITDA as a measure

of the Company's operating trends. Investors are cautioned that

EBITDA is not a measure of liquidity or of financial performance

under Generally Accepted Accounting Principles (GAAP). The EBITDA

numbers presented may not be comparable to similarly titled

measures reported by other companies. EBITDA, while providing

useful information, should not be considered in isolation or as an

alternative to net income or cash flows as determined under

GAAP.

NetSol Technologies, Inc. Forward-looking Statements

This press release may contain forward-looking statements

relating to the development of the Company's products and services

and future operation results, including statements regarding the

Company that are subject to certain risks and uncertainties that

could cause actual results to differ materially from those

projected. The words "believe," "expect," "anticipate," "intend,"

variations of such words, and similar expressions, identify

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, but their absence does

not mean that the statement is not forward-looking. These

statements are not guarantees of future performance and are subject

to certain risks, uncertainties, and assumptions that are difficult

to predict. Factors that could affect the Company's actual results

include the progress and costs of the development of products and

services and the timing of the market acceptance. The subject

Companies expressly disclaim any obligation or undertaking to

update or revise any forward-looking statement contained herein to

reflect any change in the company's expectations with regard

thereto or any change in events, conditions or circumstances upon

which any statement is based.

|

NetSol Technologies, Inc. and

|

|

|

|

Subsidiaries Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

As of March 31, 2010

|

As of June 30, 2009

|

|

|

|

ASSETS

|

Un-audited

|

|

|

Current assets:

|

|

|

|

Cash and cash equivalents

|

$ 4,275,443

|

$ 4,403,762

|

|

Restricted Cash

|

5,000,000

|

5,000,000

|

|

Accounts receivable, net of allowance for doubtful accounts

|

13,682,521

|

11,394,844

|

|

Revenues in excess of billings

|

8,497,742

|

5,686,277

|

|

Other current assets

|

2,496,949

|

2,307,246

|

|

Total current assets

|

33,952,656

|

28,792,129

|

|

Investment in associates

|

244,016

|

--

|

|

Property and equipment, net of accumulated

depreciation

|

8,457,622

|

9,186,163

|

|

Other assets, long-term

|

--

|

204,823

|

|

Intangibles:

|

|

|

|

Product licenses, renewals, enhancements, copyrights,

trademarks, and tradenames, net

|

16,492,134

|

13,802,607

|

|

Customer lists, net

|

792,040

|

1,344,019

|

|

Goodwill

|

9,439,285

|

9,439,285

|

|

Total intangibles

|

26,723,459

|

24,585,911

|

|

Total assets

|

$ 69,377,753

|

$ 62,769,026

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

Current liabilities:

|

|

|

|

Accounts payable and accrued expenses

|

$ 4,642,835

|

$ 5,106,266

|

|

Due to officers

|

13,911

|

--

|

|

Current portion of loans and obligations under capitalized

leases

|

7,134,527

|

6,207,830

|

|

Other payables - acquisitions

|

103,226

|

103,226

|

|

Unearned revenues

|

3,449,817

|

3,473,228

|

|

Dividend to preferred stockholders payable

|

--

|

44,409

|

|

Convertible notes payable , current portion

|

2,983,366

|

--

|

|

Loans payable, bank

|

2,363,507

|

2,458,757

|

|

Total current liabilities

|

20,691,189

|

17,393,716

|

|

Obligations under capitalized leases, less

current maturities

|

368,709

|

1,090,901

|

|

Convertible notes payable less current

maturities

|

4,084,024

|

5,809,508

|

|

Long term loans; less current maturities

|

886,316

|

1,113,832

|

|

Lease abandonment liability; long term

|

867,583

|

--

|

|

Total liabilities

|

26,897,820

|

25,407,957

|

|

Commitments and contingencies

|

--

|

--

|

|

|

|

|

|

Stockholders' equity:

|

|

|

|

Preferred stock, 5,000,000 shares authorized;

|

|

|

|

Nil; 1,920 issued and outstanding

|

--

|

1,920,000

|

|

Common stock, $.001 par value; 95,000,000 shares authorized;

35,961,883; 30,046,987 issued and outstanding

|

35,962

|

30,047

|

|

Additional paid-in-capital

|

85,203,134

|

78,198,523

|

|

Treasury stock

|

(396,008)

|

(396,008)

|

|

Accumulated deficit

|

(41,351,411)

|

(41,253,152)

|

|

Stock subscription receivable

|

(2,107,960)

|

(842,619)

|

|

Common stock to be issued

|

251,450

|

220,365

|

|

Other comprehensive loss

|

(8,193,790)

|

(6,899,397)

|

|

Non-controlling interest

|

9,038,556

|

6,383,310

|

|

Total stockholders' equity

|

42,479,932

|

37,361,069

|

|

Total liabilities and stockholders' equity

|

$ 69,377,753

|

$ 62,769,026

|

|

|

|

|

|

NetSol Technologies, Inc. and

Subsidiaries

|

|

|

|

Consolidated Statements of Operations

|

|

|

|

|

|

|

|

|

For the Three Months

|

For the Nine Months

|

|

|

Ended March 31,

|

Ended March 31,

|

|

|

2010

|

2009

|

2010

|

2009

|

|

Net Revenues:

|

|

|

|

|

|

License fees

|

$ 3,644,809

|

$ 324,845

|

$ 9,515,338

|

$ 3,502,632

|

|

Maintenance fees

|

1,739,799

|

1,664,492

|

5,327,852

|

4,771,519

|

|

Services

|

3,548,348

|

3,033,684

|

11,231,648

|

11,320,846

|

|

Total revenues

|

8,932,956

|

5,023,021

|

26,074,837

|

19,594,997

|

|

Cost of revenues:

|

|

|

|

|

|

Salaries and consultants

|

2,154,369

|

2,629,081

|

6,173,967

|

7,652,671

|

|

Travel

|

222,136

|

280,390

|

611,343

|

993,290

|

|

Repairs and maintenance

|

43,364

|

81,536

|

180,086

|

290,436

|

|

Insurance

|

40,235

|

43,478

|

112,943

|

135,390

|

|

Depreciation and amortization

|

578,904

|

532,099

|

1,650,676

|

1,615,853

|

|

Other

|

416,931

|

917,051

|

1,884,426

|

2,208,265

|

|

Total cost of revenues

|

3,455,939

|

4,483,635

|

10,613,442

|

12,895,905

|

|

Gross profit

|

5,477,017

|

539,386

|

15,461,395

|

6,699,092

|

|

Operating expenses:

|

|

|

|

|

|

Selling and marketing

|

651,485

|

629,145

|

1,671,866

|

2,479,509

|

|

Depreciation and amortization

|

411,563

|

501,239

|

1,341,947

|

1,476,281

|

|

Bad debt expense

|

(3,236)

|

1,772,188

|

209,604

|

2,420,658

|

|

Salaries and wages

|

746,095

|

773,757

|

2,214,760

|

2,697,531

|

|

Professional services, including non-cash compensation

|

242,177

|

257,926

|

549,078

|

877,752

|

|

Lease abandonment charges

|

(208,764)

|

--

|

867,583

|

--

|

|

General and administrative

|

1,056,718

|

862,623

|

3,188,901

|

2,693,451

|

|

Total operating expenses

|

2,896,038

|

4,796,878

|

10,043,739

|

12,645,182

|

|

Income (loss) from operations

|

2,580,979

|

(4,257,492)

|

5,417,656

|

(5,946,090)

|

|

Other income and (expenses)

|

|

|

|

|

|

Gain (loss) on sale of assets

|

(125,419)

|

(127,558)

|

(214,520)

|

(308,256)

|

|

Interest expense

|

(312,671)

|

(466,276)

|

(1,153,557)

|

(966,746)

|

|

Interest income

|

82,637

|

177,771

|

234,200

|

246,607

|

|

Gain on foreign currency exchange rates

|

(190,082)

|

8,902

|

190,495

|

1,821,754

|

|

Share of net income / (loss) in associate

|

(23,984)

|

--

|

(23,984)

|

--

|

|

Beneficial conversion feature

|

(458,758)

|

(17,225)

|

(1,351,972)

|

(17,225)

|

|

Other income

|

144,609

|

(984,622)

|

62,634

|

(952,482)

|

|

Total other income (expenses)

|

(883,667)

|

(1,409,008)

|

(2,256,704)

|

(176,348)

|

|

Net income (loss) before non-controlling interest in

subsidiary

|

1,697,312

|

(5,666,500)

|

3,160,952

|

(6,122,438)

|

|

Non-controlling interest

|

(1,097,201)

|

689,584

|

(3,235,093)

|

(972,238)

|

|

Income taxes

|

(11,064)

|

(21,594)

|

(48,607)

|

(79,631)

|

|

Net income (loss)

|

589,047

|

(4,998,510)

|

(122,748)

|

(7,174,308)

|

|

Dividend required for preferred stockholders

|

--

|

(33,140)

|

--

|

(100,892)

|

|

Net income (loss) applicable to common

shareholders

|

589,047

|

(5,031,650)

|

(122,748)

|

(7,275,200)

|

|

Other comprehensive income (loss):

|

|

|

|

|

|

Translation adjustment

|

(439,688)

|

(179,358)

|

(1,294,393)

|

(4,036,926)

|

|

Comprehensive income (loss)

|

$ 149,359

|

$ (5,211,008)

|

$ (1,417,141)

|

$ (11,312,126)

|

|

|

|

|

|

|

|

Net income (loss) per share:

|

|

|

|

|

|

Basic

|

$ 0.02

|

$ (0.19)

|

$ (0.004)

|

$ (0.27)

|

|

Diluted

|

$ 0.02

|

$ (0.19)

|

$ (0.004)

|

$ (0.27)

|

|

Weighted average number of shares outstanding

|

|

|

|

|

Basic

|

35,636,259

|

26,601,587

|

33,893,968

|

26,350,098

|

|

Diluted

|

36,988,542

|

26,601,587

|

33,893,968

|

26,350,098

|

|

|

|

|

|

|

|

NetSol Technologies, Inc. and Subsidiaries

|

|

|

Consolidated Cash Flow Statements

|

|

|

|

|

|

|

For the Nine Months

|

|

|

Ended March 31,

|

|

|

2010

|

2009

|

|

Cash flows from operating activities:

|

|

|

|

Net income (loss)

|

$ (122,748)

|

$ (7,174,308)

|

|

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

|

|

|

|

Depreciation and amortization

|

2,992,624

|

3,092,134

|

|

Provision for bad debts

|

209,604

|

2,420,658

|

|

Gain on sale of subsidiary shares in Pakistan

|

--

|

308,256

|

|

Loss on foreign currency exchange rates

|

25,900

|

--

|

|

Share of net (income)/loss from associates

|

23,984

|

--

|

|

Loss on sale of assets

|

214,520

|

--

|

|

Non controlling interest in subsidiary

|

3,235,093

|

972,238

|

|

Stock issued for notes payable and related interest

|

30,207

|

--

|

|

Stock issued for services

|

572,184

|

227,516

|

|

Fair market value of warrants and stock options

granted

|

791,530

|

147,639

|

|

Beneficial conversion feature

|

1,351,972

|

17,225

|

|

Changes in operating assets and

liabilities:

|

|

|

|

Increase/ decrease in accounts receivable

|

(2,658,139)

|

(3,934,511)

|

|

Increase/ decrease in other current assets

|

(2,703,402)

|

3,175,947

|

|

Increase/ decrease in accounts payable and accrued

expenses

|

(52,914)

|

588,689

|

|

Net cash provided by operating

activities

|

3,910,415

|

(158,517)

|

|

Cash flows from investing activities:

|

|

|

|

Purchases of property and equipment

|

(1,458,050)

|

(1,501,508)

|

|

Sales of property and equipment

|

232,783

|

13,376

|

|

Payments of acquisition payable

|

--

|

(742,989)

|

|

Purchase of treasury stock

|

--

|

(360,328)

|

|

Investment in associate

|

(268,000)

|

--

|

|

Short-term investments held for sale

|

--

|

--

|

|

Increase in intangible assets

|

(4,562,044)

|

(5,281,642)

|

|

Net cash used in investing activities

|

(6,055,311)

|

(7,873,091)

|

|

Cash flows from financing activities:

|

|

|

|

Proceeds from sale of common stock

|

754,509

|

146,652

|

|

Proceeds from the exercise of stock options and

warrants

|

33,750

|

526,569

|

|

Purchase of subsidary stock in Pakistan

|

--

|

(250,000)

|

|

Finance costs incurred for sale of common stock

|

|

|

|

Proceeds from convertible notes payable

|

3,500,000

|

6,000,000

|

|

Redemption of preferred stock

|

(1,920,000)

|

--

|

|

Restricted cash

|

--

|

(5,000,000)

|

|

Dividend Paid

|

(43,988)

|

(33,876)

|

|

Bank overdraft

|

(176,377)

|

161,134

|

|

Proceeds from bank loans

|

4,320,534

|

3,843,541

|

|

Payments on bank loans

|

(484,507)

|

(235,486)

|

|

Payments on capital lease obligations & loans -

net

|

(3,664,176)

|

(467,397)

|

|

Net cash provided by financing

activities

|

2,319,746

|

4,691,137

|

|

Effect of exchange rate changes in

cash

|

(303,170)

|

(453,178)

|

|

Net increase in cash and cash

equivalents

|

(128,319)

|

(3,793,649)

|

|

Cash and cash equivalents, beginning of year

|

4,403,762

|

6,275,238

|

|

Cash and cash equivalents, end of

year

|

$ 4,275,443

|

$ 2,481,591

|

|

|

|

|

CONTACT: RedChip Companies, Inc.

Investor Relations Contact:

Chris Schilling

800-733-2447, Ext. 131

407-644-4256, Ext. 131

info@redchip.com

http://www.redchip.com

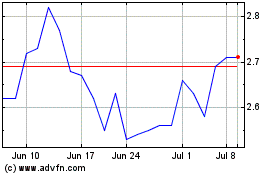

NetSol Technologies (NASDAQ:NTWK)

Historical Stock Chart

From Apr 2024 to May 2024

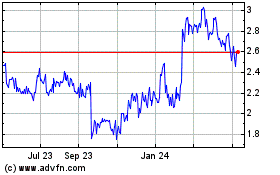

NetSol Technologies (NASDAQ:NTWK)

Historical Stock Chart

From May 2023 to May 2024